rhode island property tax rates 2020

Due Dates 1st quarter. Tax amount varies by county.

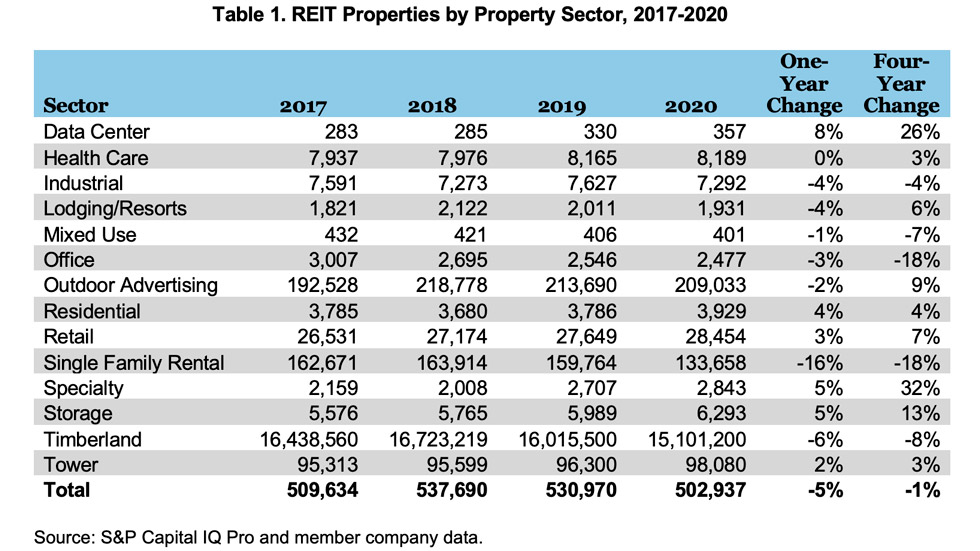

Reits Own 503 000 Properties In The U S Nareit

That number recently ticked up to 1474.

. Rhode Island Property Tax. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. See Results in Minutes.

Includes All Towns including Providence Warwick and Westerly. Instead if your taxable income. 135 of home value.

DO NOT use to figure your Rhode Island tax. Pensions Benefits Toggle child menu. Newport has a property tax rate of 933.

The countys average effective property tax rate is. 2016 Tax Rates. 41 rows Map and List of Rhode Island Property Tax Rates - Lowest and Highest RI Property Taxes - Includes Providence Warwick and Westerly.

Rhode Islands largest county by area and by population Providence County has the highest effective property tax rates in the state. Westerly has a property tax rate of 1152. 7 Rates rounded to two decimals 8 Denotes homestead exemption available 9 Central Falls single family and multifamily owner occupied real property tax rate is 1818.

For tax roll year 2020 the property tax rate for Cumberland was 1432. Narragansett has a property tax rate of 886. Tax Rates for the 2022-2023 Tax Year.

Recent Tax Rate History - Tax Rates from 1893 - 1996. The State of Rhode Island has eliminated. FY2023 starts July 1 2022 and ends June 30 2023There was no increase in our tax rates from last year the tax rates remainResidential Real Estate - 1873Commercial.

The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000. Property Tax Cap. 2020 Rhode Island Property Tax Rates on a Map - Compare Lowest and Highest RI Property Taxes Easily.

Ad Enter Any Address Receive a Comprehensive Property Report. Please visit the State of Rhode Island website for additional information on municipal property tax rates budgets pension and OPEB. 1463 for Real Estate and Tangible Property.

The municipality of Burrillville also saw a notable rise in. Jamestown has a property tax rate of 828. Real Tangible Tax Rate - 20211152 per 1000 Non-Sewer District1206 per 1000 Sewer DistrictMotor Vehicle Tax Rate - 20212967 per 1000 500 State Exemption and 4500.

Buffalo Ny Cost Of Living Guide 2020 Is Buffalo Affordable Wayfinder Moving Services Cost Of Living Moving Services Cost

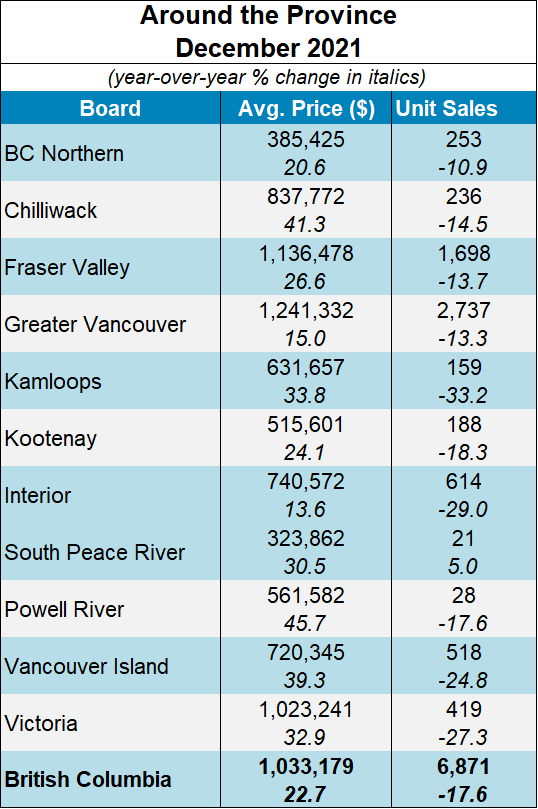

A Record Year For The Bc Housing Market British Columbia Real Estate Association

![]()

Reit Earnings Rose 24 6 In 2021 Exceed Pre Pandemic Levels Nareit

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

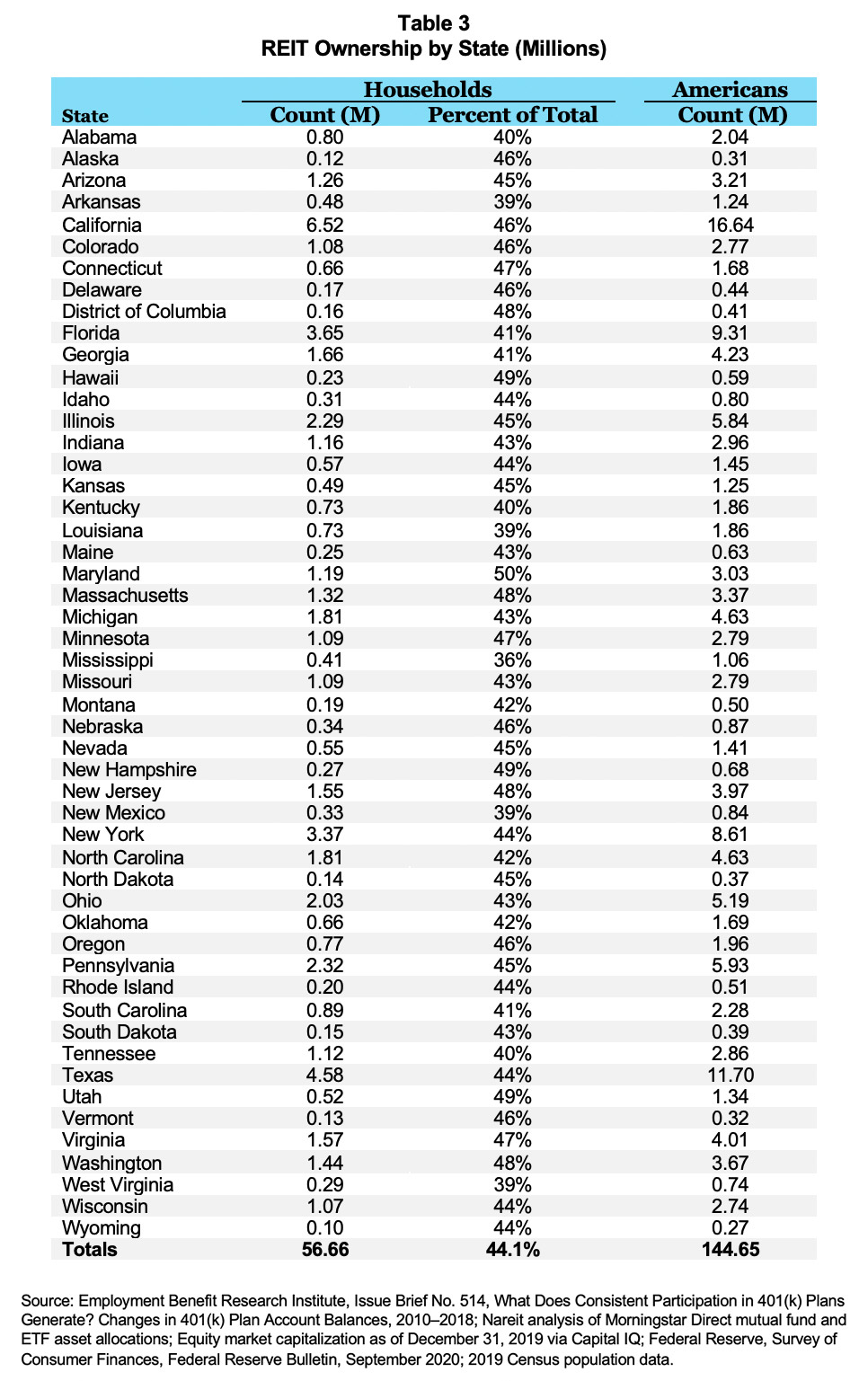

145 Million Americans Own Reit Stocks Nareit

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Rhode Island Property Tax Calculator Smartasset

Luxurious Suites At The Broadmoor Resort In Colorado Springs Luxury Suite Suites Luxury

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

N338 94 Billion Was Generated As Vat In Q1 Nbs Nigeria National Nigerian

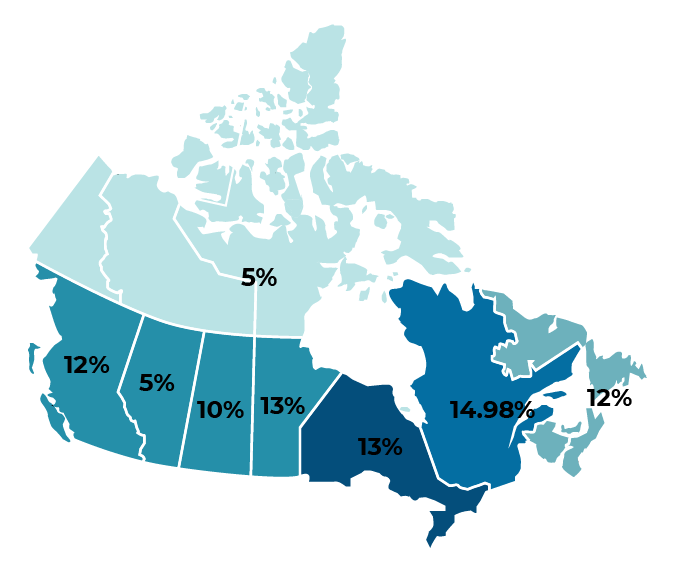

Which Province In Canada Has The Lowest Tax Rate Transferease

A Record Year For The Bc Housing Market British Columbia Real Estate Association

State Corporate Income Tax Rates And Brackets Tax Foundation

Covid 19 Epidemiology Update Detailed Data Maps Charts Canada Ca

Property Taxes How Much Are They In Different States Across The Us

Bhk Individual House For Sale In Kk Nagar Trichy Rei Bhalla Anime Modern Plans Spelle In 2020 Small House Elevation Design Architectural House Plans House Front Design