b&o tax wv

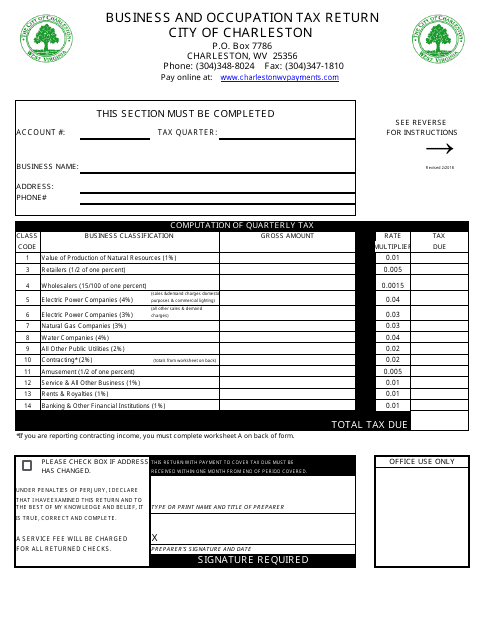

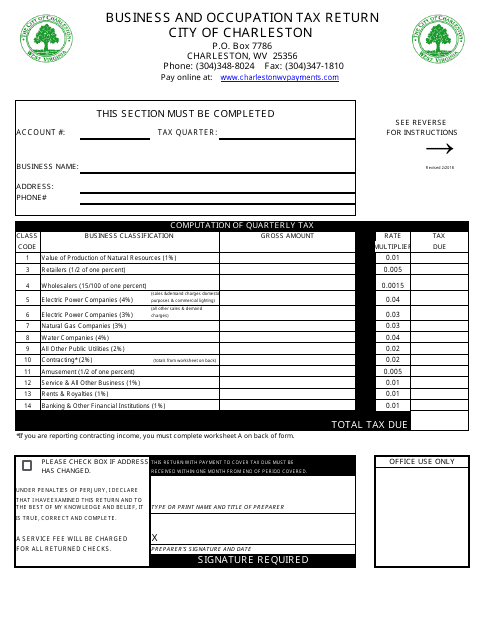

All persons engaging in business activities in the City of Charleston are subject to the BO Tax unless specifically exempted by Chapter 110 Article II Section 110-63 of the Code of the City of Charleston. Businesses engaged in multiple.

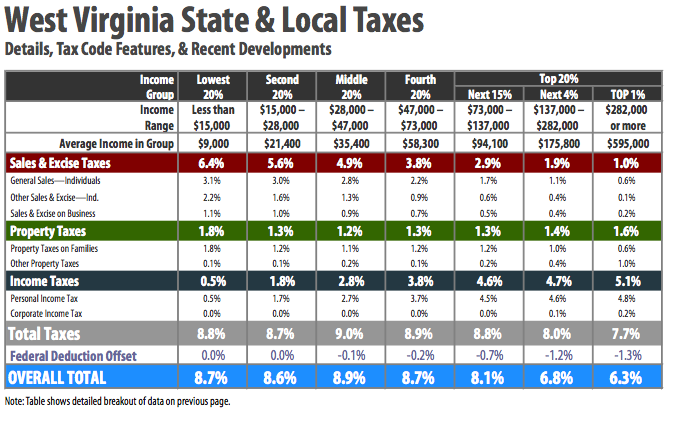

The Charleston Tax Shift Is It Worth It West Virginia Center On Budget Policy

409 S Kanawha Street.

. BUSINESS AND OCCUPATION TAX RETURN. Box 5097 Vienna WV 26105-5097. We are here to provide you with efficient government services to assist your living recreational work and business needs.

Charleston West Virginia government works for you. It is a type of gross receipts tax because it is levied on gross income rather than net income. There is levied upon and shall be collected from any person engaging or continuing in any business or other activities set forth in Section 78703 annual privilege taxes in an amount to be determined by the application of the rate hereinafter set forth in this section against values or gross income of the taxpayer for the tax year.

States of Washington West Virginia and as of 2010 Ohio and by municipal governments in West Virginia and Kentucky. BO Tax is measured by the application of rates against values of products gross proceeds of sale or gross income of the business as the case may be. For assistance call 3046965540 press option 4 for the Finance Division BO TAXES WAIVED FOR RETAIL RESTAURANT AND OTHER TAX CLASSIFICATION.

Gross income or gross proceeds of sales derived from sales within West Virginia which is not taxed or taxable by any other municipality are included in the measure of Charleston BO Tax if the sales are either directed from a city location or if the taxpayers. Also effective July 1 2016 the City is reducing the Business and Occupation Tax rate on. All persons engaging in business activities in the City of Charleston are subject to the BO Tax unless specifically exempted by.

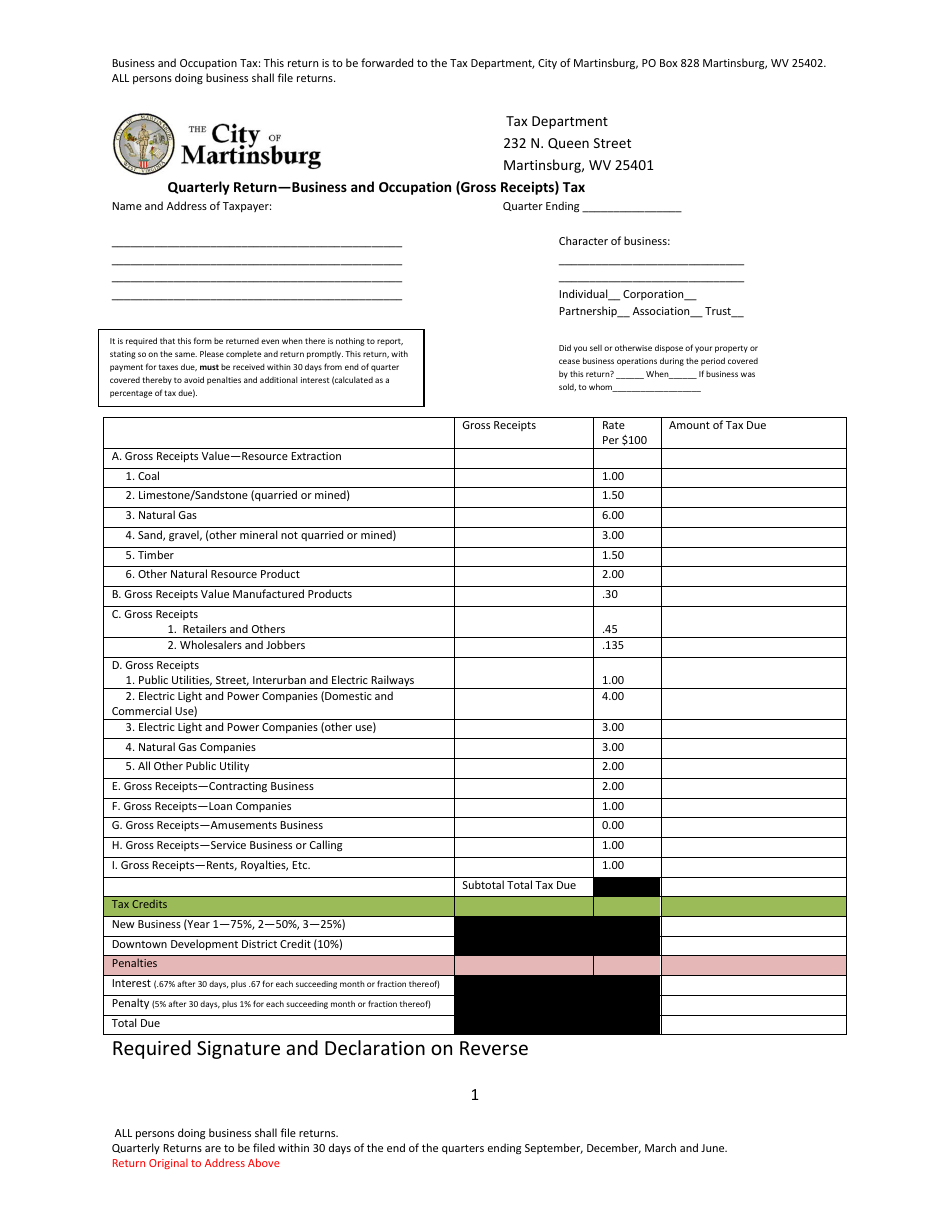

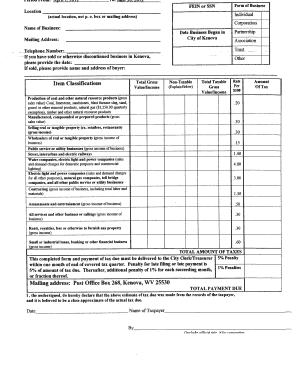

BOX 307 BUFFALO WV 25033 Town of Buffalo - Business Privilege and Occupation Gross Sales Tax - Quarterly Return Quarterly Return for Quarter Ended. Either by downloading a PDF and filling it out by hand or downloading the new B and O Tax Worksheet in Microsoft Excel to keep for your own records. This tax is collected from anyone conducting business within the corporate limits of the City of Martinsburg.

The business and occupation tax often abbreviated as BO tax or BO tax is a type of tax levied by the US. Determine your taxes due by multiplying the rate by the taxable income. Mayor Williams waived Retail Restaurant Others BO Tax Classification 5 on September 13 2021.

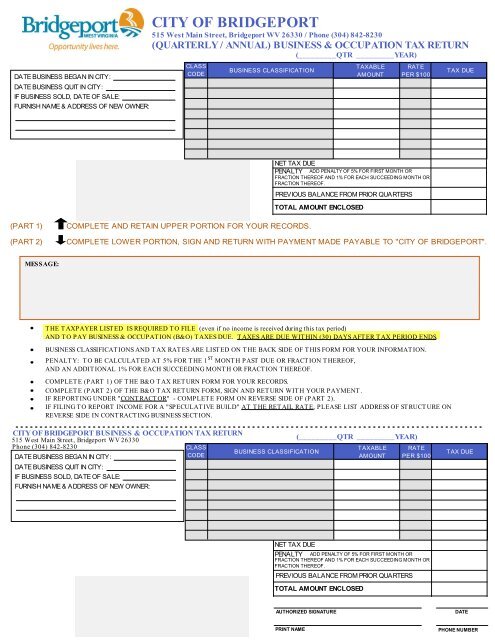

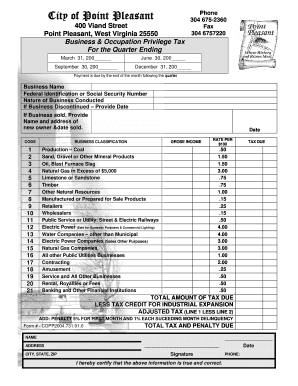

CITY OF CLARKSBURG 222 West Main Street Clarksburg WV 26301 Phone 304 624-1630 QUARTERLY ANNUAL BUSINESS OCCUPATION TAX RETURN. Several categories of BO tax in order to benefit small business owners. The rates and tax base are determined by specified classifications based upon.

Determine your Business Classifications and corresponding rates from the tax table. B O Tax. City of Fairmonts ordinance number 1655 with an effective date of October 8 2015 provides for the imposition administration collection and enforcement of a Consumers Sales and Service Tax and a Complimentary Use Tax of 1 on state taxable sales.

The following general principles determine tax liability under the municipal BO Tax. Primary source of revenue for the City of Morgantown is the Business Occupation BO Tax as permitted under West Virginia Code Section 8-13-5 et seq. THE TAXPAYER LISTED BELOW IS REQUIRED TO FILE.

West Virginia Code 11-10-llc and the requirements of the Streamlined Sales and Use Tax Administration Act as codified in West Virginia Code 11-15B-1 et seq. Determine you Charleston BO taxable gross income for each of the classifications and enter it in the appropriate box. The West Virginia Municipal Business and Occupation Tax BO Tax is an annual privilege tax imposed on all persons and entities doing business in West Virginia municipalities that impose the tax.

As allowed by WV State Code the City of Spencer seeks to enact a municipal sales and use tax while reducing. This legislation is effective July 1 2016. Contracting class instructions are listed below 3.

Tax Return Form Businesses choose which way to submit Tax returns. The rates classifications and exemptions governing the application of BO taxes were adopted for use by the State of West. AND TO PAY BUSINESS OCCUPATION BO TAXES DUE.

The amount of tax is determined by the application of rates against values or gross income. Of these 117 impose a business and occupation tax in some form and the other 117 municipalities do not impose a business and occupation tax. Return by the due date to avoid delinquent notices and tax assessments.

The Citys B O Tax is based on the gross income gross receipts of each business. Please Provide Phone Number. Beginning on July 1st of each fiscal year the City collects Business and Occupation BO Taxes.

The main revenue source for West Virginia cities is the business and occupation tax generated by any commercial activity locate within the City limits. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs. BO Tax is measured by the application of rates against values of products gross proceeds of sale or gross income of the business as the case may be.

Information on BO Taxes for Charleston WV. Municipalities that do not impose a business and occupation tax are authorized in W. Even if no income is received during this tax period.

Gross Receipts Rents Royalties Etc. FORM 101 - B O TAX this to be forwarded to. Code 8-13C-4 and 5 to impose municipal sales and use taxes at a rate not to exceed one percent.

PO Box 2514 Beckley WV 25802. The second years B and O Tax would be on 20000 75 credit on the difference between year before expansion and second year after expansion and B and O Tax in the third year would be on 30000 50 credit on the difference between year prior to expansion and third year after expansion.

/cloudfront-us-east-1.images.arcpublishing.com/gray/5TPE3UYTCRB4TE4XNTL57XBUE4.JPG)

W Va Cities Receive Budget Cut Under Proposed Bill In Legislature Mayors Speaking Out Against It

Quarterly Return Business And Occupation Gross Receipts Tax Download Fillable Pdf Templateroller

Business Amp Occupation Tax Return Rates City Of Bridgeport

2015 City Of Huntington Business And Occupation Tax Return Form Download Printable Pdf Templateroller

Fillable Online City B O Tax Form R Fax Email Print Pdffiller

City Of Logan West Virginia New B O Tax Forms And Business License Update Forms Are Being Sent Out Beginning August 1st With The Revised Rates All Fees Will Be Due October

Wv Sales Pratt Form Fill Online Printable Fillable Blank Pdffiller

West Virginia Firefighters Share Concerns About Proposal To Slash B O Taxes Wowk

Kenova Wv B O Tax Form Fill Online Printable Fillable Blank Pdffiller

West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

Wv Cities Worry About B O Tax Cuts

Treasury Business Occupation Tax Bluefield West Virginia

/cloudfront-us-east-1.images.arcpublishing.com/gray/5TPE3UYTCRB4TE4XNTL57XBUE4.JPG)

W Va Cities Receive Budget Cut Under Proposed Bill In Legislature Mayors Speaking Out Against It